A FARM GATE APPROACH

You have more invested in your crops today than ever before, so managing risk is essential. At MKC, our vision is to help producers protect revenue and preserve equity by combining crop insurance, crop input contracting and financing, and grain marketing. Together, our programs reduce risk, increase revenue and improve the quality of life.

CREATING AND EXECUTING A PLAN FOR PROFITS

We operate one of the most progressive and comprehensive producer risk management programs in the industry. Our Grain Marketing Specialists have the expertise and knowledge to provide grain marketing strategies that revolve around managing revenue on a per-acre basis. Our approach to grain marketing is to bring services directly to your kitchen table on a regular basis to customize your risk management plan. We develop flexible grain marketing plans that truly fit your individual needs.

Profit vs price mentality

Our whole-farm approach to risk management focuses on maximizing your revenue potential. We evaluate your crop inputs, crop insurance and grain marketing variables to set up a framework for decision making. Our focus is on planning based on your entire farm, not the price of a specific commodity.

Flexibility

We build in flexibility in delivery points, contracting operations, farming plans and more. We understand each farming operation and customer is different, which is why we believe it is important to allow adjustments to fit your changing needs.

FORWARD CONTRACTING

Locking in profitable prices is essential to executing a successful marketing plan. Our forward contract offerings allow you to take advantage of opportunities in the market through a variety of traditional and modern marketing alternatives. A few examples include:

Cash

This is a straightforward transaction in which a seller agrees to deliver a cash commodity to a buyer at some point in the future for a specified price.

Hedge to Arrive (HTA)

In this contract, the futures price is set, but the basis level is set later (typically before delivery). A producer might use this contract when futures prices are advantageous, but the basis is not.

Option Contracts

For producers, options are a way to insure the price of a crop. Unlike futures contracts, which provide protection against volatile price movements by “locking in” desired price levels, options allow producers to benefit if prices move in their favor. This protection is provided at a known cost (premium); and options buyers never have a margin call.

Over-The-Counter (OTC)

These customized contracts rely on derivatives to manage price risk. Some contracts provide market protection using averaging techniques, while others more closely resemble exchange-traded options with non-traditional expiration dates. All these contracts can be used in a comprehensive marketing plan to manage price risk more effectively with the help of your local Grain Marketing Specialist.

Offer Contract

Producers may enter into an agreement where they make firm “offers” to enter a cash grain contract. MKC will then accept that offer if market conditions allow. If a producer has a price goal in mind, this contract puts it in writing and gives them something to watch and monitor.

DIRECT SHIP

Even if you are outside our elevator footprint, we can still work with you and your grain marketing plan. We can help you find the most profitable market with direct-ship destinations that take advantage of our daily contacts with regional processors.

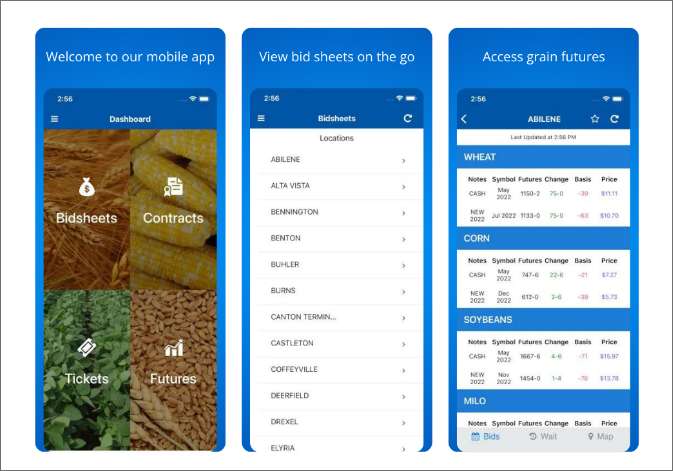

PRODUCER AG APP

Put your grain account in the palm of your hand with the Producer Ag App. Gain access to local bids and futures and view your account information anytime,

Contact Crop Insurance anywhere, right from your phone. You can also retrieve grain contracts, payment information, scale tickets, and more.

GET THE PRODUCER AG APP

CROP INSURANCE

Crop insurance is an essential tool to manage risk and maximize revenue. When paired with a grain marketing plan, it becomes even more valuable by giving you confidence to sell bushels yet to be harvested when the price is right. Our Crop Insurance Specialists have earned national recognition and have extensive training and experience in grain marketing. They can help you determine which policy best fits your needs by utilizing industry-leading risk management programs.

CROP INSURANCE PROGRAMS

When you work with us for crop insurance, we’ll help customize an insurance program that helps you maximize your revenue potential. Some examples of the programs we offer include:

Multi-peril crop insurance (MPCI)

MPCI allows participating producers to insure a certain percentage of historical crop production. MPCI insurance policies provide coverage for production losses caused by natural perils, or a combination of yield and price coverage. Combination products cover loss in value because of a change in market price during the crop insurance period, in addition to perils covered by the standard loss of yield coverage.

Pasture, Rangeland and Forage

This insurance product is designed to help protect a producer’s operation from the risks of forage loss due to a lack of precipitation. Coverage is based on a producer’s selection of coverage level, index intervals, and productivity factor. Policyholders can select a coverage level from 70 to 90 percent

Hail Insurance

Crop-hail coverage provides protection against physical damage from hail, and in many cases will include extended coverages like fire and lightning, wind, vandalism and malicious mischief. Crop-hail insurance is different from MPCI because it is not part of the federal crop insurance program. Instead, private crop insurance companies sell these policies, and premiums are not subsidized.

Livestock Risk Insurance

MKC also offers the Livestock Risk Protection Insurance Plan for Fed Cattle (LRP-Fed Cattle) to insure against declining market prices. We offer a variety of coverage levels and insurance periods that correspond with the time your market-weight cattle would normally be sold. Please contact us for more details on these insurance programs to determine which policies are right for your operation.

2024 CROP INSURANCE PRICES

| BASE PRICE | HARVEST PRICE | |||

| Commodity | Discovery | Final | Discovery | Final |

| 2024 Corn (CZ24) | 2/1 – 2/28 | $4.71* | 10/1 – 10/31 | $0.00 |

| 2024 Soybeans (SX24) | 2/1 – 2/28 | $11.68* | 10/1 – 10/31 | $0.00 |

| 2024 Grain Sorg. (CZ24) | 2/1 – 2/28 | $4.72* | 6/1 – 6/30 | $0.00 |

| 2024 Wheat (KEN24) | 8/15 – 9/14 | $7.34 | 6/1 – 6/30 | $0.00 |

| 2024 Canola (ICE24) | 7/15 – 8/14 | $0.27 | 6/1 – 6/30 | $0.00 |

| YEAR | BASE PRICE | HARVEST PRICE |

| 2001 | $2.46 | $2.05 |

| 2002 | $2.32 | $2.52 |

| 2003 | $2.42 | $2.37 |

| 2004 | $2.83 | $1.99 |

| 2005 | $2.32 | $1.93 |

| 2006 | $2.59 | $3.56 |

| 2007 | $4.06 | $3.82 |

| 2008 | $5.40 | $3.74 |

| 2009 | $4.04 | $3.90 |

| 2010 | $3.99 | $5.52 |

| 2011 | $6.01 | $6.32 |

| 2012 | $5.68 | $7.50 |

| 2013 | $5.65 | $4.39 |

| 2014 | $4.62 | $3.49 |

| 2015 | $4.15 | $3.83 |

| 2016 | $3.86 | $3.49 |

| 2017 | $3.97 | $3.49 |

| 2018 | $3.96 | $3.68 |

| 2019 | $4.00 | $3.90 |

| 2020 | $3.88 | $3.99 |

| 2021 | $4.58 | $5.37 |

| 2022 | $5.90 | $6.86 |

| 2023 | $5.91 | $4.88 |

| YEAR | BASE PRICE | HARVEST PRICE |

| 2001 | $4.67 | $4.37 |

| 2002 | $4.50 | $5.45 |

| 2003 | $5.26 | $7.32 |

| 2004 | $6.72 | $5.26 |

| 2005 | $5.53 | $5.75 |

| 2006 | $6.18 | $5.93 |

| 2007 | $8.09 | $9.75 |

| 2008 | $13.36 | $9.22 |

| 2009 | $8.80 | $9.66 |

| 2010 | $9.23 | $11.63 |

| 2011 | $13.49 | $12.14 |

| 2012 | $12.55 | $15.39 |

| 2013 | $12.87 | $12.87 |

| 2014 | $11.36 | $9.65 |

| 2015 | $9.73 | $8.91 |

| 2016 | $8.85 | $9.75 |

| 2017 | $10.19 | $9.75 |

| 2018 | $10.16 | $8.60 |

| 2019 | $9.54 | $9.25 |

| 2020 | $9.17 | $10.54 |

| 2021 | $11.87 | $12.30 |

| 2022 | $14.33 | $13.81 |

| 2023 | $13.76 | $12.84 |

| YEAR | BASE PRICE | HARVEST PRICE |

| 2001 | $3.31 | $3.00 |

| 2002 | $3.34 | $3.40 |

| 2003 | $3.73 | $3.00 |

| 2004 | $3.40 | $3.64 |

| 2005 | $3.56 | $3.35 |

| 2006 | $3.52 | $5.02 |

| 2007 | $4.52 | $6.02 |

| 2008 | $5.88 | $8.60 |

| 2009 | $8.77 | $5.48 |

| 2010 | $5.42 | $5.38 |

| 2011 | $7.14 | $8.18 |

| 2012 | $8.62 | $6.75 |

| 2013 | $8.78 | $7.22 |

| 2014 | $7.02 | $7.17 |

| 2015 | $6.30 | $5.31 |

| 2016 | $5.20 | $4.50 |

| 2017 | $4.59 | $4.59 |

| 2018 | $4.87 | $5.07 |

| 2019 | $5.74 | $4.63 |

| 2020 | $4.35 | $4.44 |

| 2021 | $4.90 | $6.21 |

| 2022 | $7.08 | $10.88 |

| 2023 | $8.79 | $8.20 |

WEATHER OUTLOOK

By Brian Bledsoe